Players who own two or more qualifying houses across all their accounts (determined by OutlandsID) will now be subject to Housing Taxes. This system will officially go into effect on April 15, 2025. Until that date, players will not accumulate any taxes, though they can preview their potential tax amounts in the Housing Menu.

Housing Tax Menus

If a player qualifies for Housing Taxes or has unpaid taxes, a Housing Taxes section will appear in the Overview Page of their Housing Menu. Clicking the "Details" button provides access to a detailed Tax Report, explaining the breakdown of their taxes.

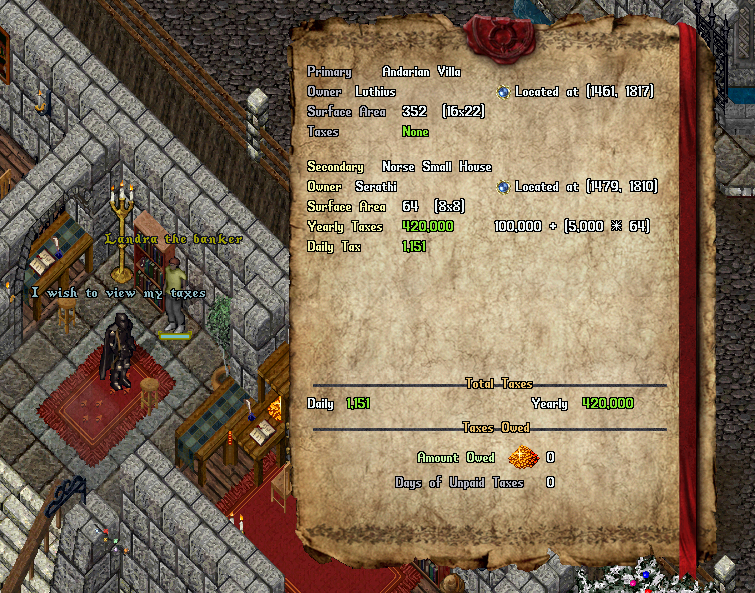

Bankers

Players can also check their housing tax status by speaking to a Banker NPC. Saying the word "Tax" near a banker or selecting the Housing Taxes option from the context menu will display the player's Tax Report.

Qualifying and Exempt Houses

By default, all player-owned houses and houseboats are subject to Housing Taxes. However, certain house types are exempt and will not be taxed. The exempt house types include:

- Prestige Guild Houses

- Rental Rooms

These properties will not contribute to a player's Housing Taxes.

Who Qualifies for Housing Taxes

Only players who own two or more qualifying houses across their accounts (by OutlandsID) will be subject to Housing Taxes. Players who own only a single house will not be taxed.

Surface Area Calculation

The tax amount for a house is determined by its Surface Area, which is calculated as the total ground floor area (Width × Height).

For example, a house with dimensions of 16×22 would have a total Surface Area of 352 tiles.

Players can find their house's dimensions in the following ways:

- The Home Surveying Tool menu

- The Housing Taxes menu

- The Outlands Wiki housing section

Ranking Houses

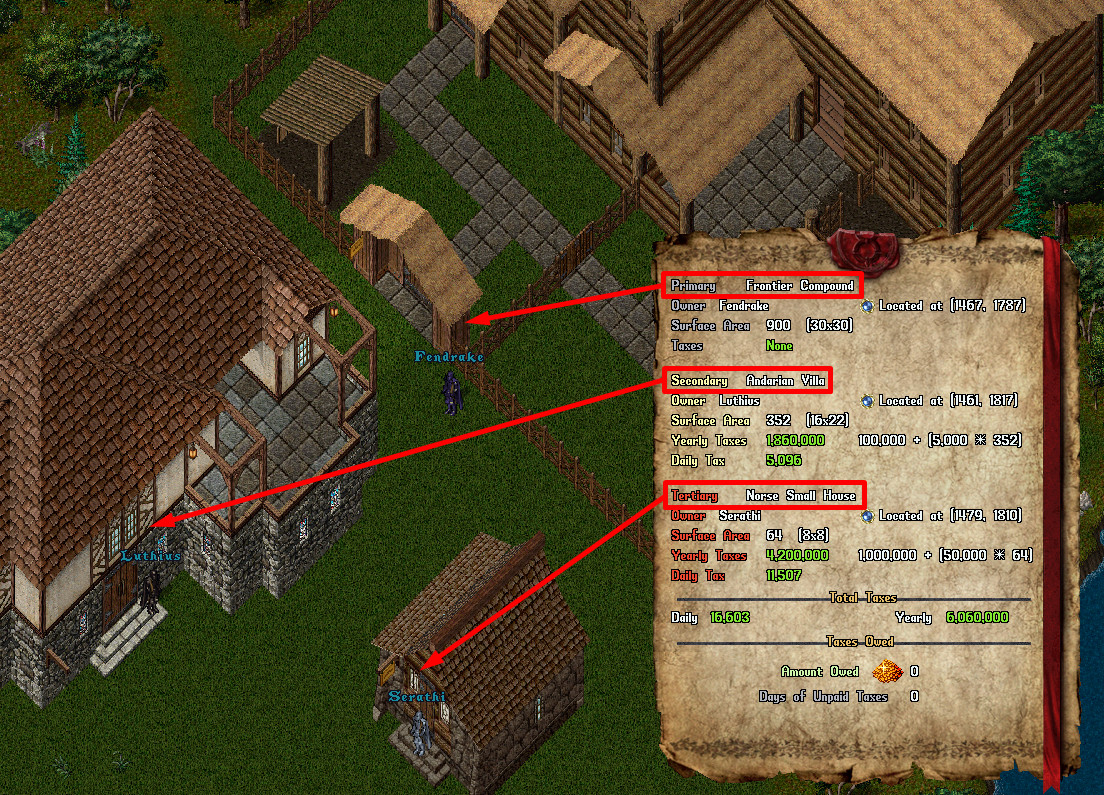

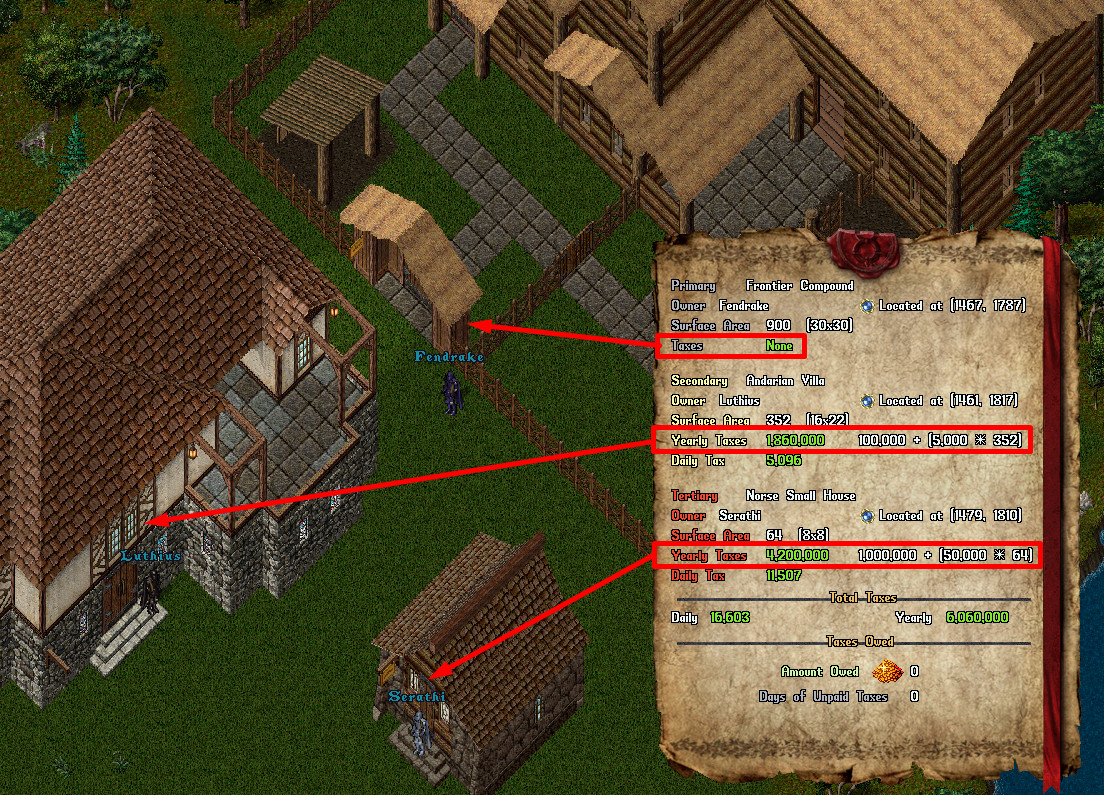

To determine tax amounts, a player’s qualifying houses are ranked based on their Surface Area. The ranking system is as follows:

- The largest house is considered the Primary House and is exempt from taxes.

- The second-largest house is classified as the Secondary House and taxed at a moderate rate.

- The third-largest and any additional houses are classified as Tertiary Houses, incurring significantly higher taxes.

Exempt house types (Rental Rooms and Prestige Guild Houses) are never ranked and do not impact a player's tax obligations.

Yearly Tax Amounts

The amount of tax a house incurs is based on its ranking:

| House | Yearly Tax |

|---|---|

| Primary | None |

| Secondary | (100,000 + (5,000 × Surface Area)) Gold |

| Tertiary | (1,000,000 + (50,000 × Surface Area)) Gold |

Accumulating Taxes

Housing Taxes are calculated daily. The daily tax for each house is derived by dividing its yearly tax amount by 365:

- Daily Tax Amount = (Yearly Tax / 365)

- The total amount owed is the sum of all daily tax amounts for all qualifying houses.

Players can track their Total Amount Owed and Days of Unpaid Taxes through their Housing Menu or Tax Report.

It is important to note that there is no end-of-year lump sum payment; taxes accumulate daily and must be paid as the player sees fit.

Paying Taxes

Players can pay their outstanding tax balance at any time. To do so, they must select the "Pay Amount Owed" button in either the Housing Menu or Tax Report menu. This action deducts the owed amount from their bank balance and resets both the Amount Owed and Days of Unpaid Taxes to zero.

Excessive Unpaid Taxes

If a player accumulates 30 or more days of unpaid taxes, they will be flagged as having Excessive Unpaid Taxes. This status imposes the following restrictions:

- House Refreshing Disabled – None of the player's houses (across all accounts linked to their OutlandsID) can be refreshed, even by the owner.

- No House Placement – The player is prohibited from placing new houses.

- No House Transfers – The player cannot take control of existing houses through transfer, trade, purchase, or lottery.

If a player reaches this status, the "Days of Unpaid Taxes" counter will display in red text in the Housing Menu.

Warning Alerts

Players with Excessive Unpaid Taxes will receive a warning message and sound alert each time they log in or attempt to refresh their houses. Additionally, any Co-Owners or Friends attempting to refresh the house will receive a message notifying them that refreshing is no longer possible.

Daily Taxes When Transferring Houses

If a player transfers or sells a house during the day, their taxes for that day will be based on the highest amount they owed at any point that day. This measure prevents players from temporarily transferring houses to avoid tax accumulation.

System Going Live

The Housing Tax system will officially launch on April 15, 2025. Until this date, players will not accrue taxes. However, they can preview their potential tax amounts in the Housing Menu and make any necessary adjustments to their housing setup.

Until the system is live, a message stating "HOUSING TAXES ARE DISABLED UNTIL APRIL 15" will appear in the Housing and Tax Report menus.